Key Elements of Successful NFT Collectibles Explained

What you always wanted to know to kickstart your own NFT collectible project

Launching a new NFT collectibles project is exciting and thrilling. You'll probably feel like you're on a roller coaster of emotions, with intense ups and downs depending on how the drop emerges. But why are we after these NFTs so much? The short answer is that we collect things because we give them a particular value and get guided by emotions. There are several reasons why we value something:

First of all scarcity, the limited supply

The creator, which we believe in

The novel idea

The stunning artwork itself

The brilliant use cases

Exclusive access to groups, events, etc.

Becoming part of an amazing culture

Or simply because it's so absurd that it may work, like "My Fucking Pickle" successfully taught us

Usually, it's not just one of the points listed above, but a good mix.

Compare it with "Pokémon" or "Magic: The Gathering" trading card games, which have a broad set of cards with many different values and rarities. However, their rarest are traded for significant amounts because passionate collectors are willing to pay high sums to acquire that super rare missing piece to complete their collection.

This article is primarily intended for people who want to start their own NFT collectible project and users who desire to understand the complex NFT world more thoroughly.

Get Ready for an Emotional Takeover

Before we dig into the NFT collectible world, I'd like to talk about our emotions. Did you know that emotions significantly influence our decisions, and we usually do not even notice them? Being aware of that fact will help you to counter the emotional takeover and act more rationally.

FUD (fear, uncertainty, and doubt) will make us less confident, so we probably don't buy an NFT because there are too many unanswered questions

FOMO (fear of missing out), for example, "If I don't buy this NFT now, it will go to the moon without me"

Another typical thought based on greed that we all know, especially when it's about selling beloved NFTs and taking profit: "If I just keep hodling, then I'll get even more profit and can finally buy a Lambo and tell my mom I made it", this often ends with "I wish I had"

Basically, the whole NFT space is fueled by FOMO, so it's essential to keep this in mind when creating an NFT project. You can significantly influence emotions and, therefore, decisions with the right elements.

Successful NFTs Have Strong Foundations

With blockchain technology, it has become much easier to produce and trade collectibles, as the current boom shows us. So let's identify the foundations of successful NFT collectible projects, which can be categorized as follows:

The idea

The collectibles

The drop

The community

You'll get the most significant points for each category based on my experience in the NFT and crypto space since 2015.

1) Long-Term Sustainable Ideas Win

There are daily numerous new NFT collectibles dropping, and most of them are just low-effort copies with no other intention than getting as much money as quickly as possible - the so-called cash grabs. While often successful, these hyped cash grabs are not sustainable in the long run because they are not thought out enough; most of their users will abandon the project.

Set No Limits to Your Creativity

If you have an idea that sounds super crazy, but you can't stop thinking about it, great! Assemble a team and start working out the details of your vision and let it grow. There are so many talented people in the NFT space; you'll always find a way to realize the apparently impossible. Did you ever check the Twitter profiles of the well-connected BAYC (Bored Ape Yacht Club) members? It seems like almost everyone is involved in multiple projects - we're all makers and (banana) shakers.

Be Unique Without Re-Inventing the Wheel

The whole NFT space is so young, we're in an experimental phase, and some things become the new meta while others fail. The NFT community appreciates projects that are bold enough to do experiments and strive for uniqueness. That said, it's also totally fine to integrate best practices without re-inventing the wheel. A mix of innovative and established methods has the ideal ingredients for success.

What is your unique selling proposition (USP), or in other words, what makes your project unique? What are your use cases, and why should someone consider buying your NFTs? Unfortunately, most projects can't answer these questions because they don't have any USP at all. An example of a successful NFT project is the Pixel Vault ecosystem and its genius tokenomics, including fractionalized NFT ownership as a USP.

Want a few examples? Here we go:

The Lazy Lions have created a whole platform called ROARwards dedicated to incentivizing their community for spreading the word about the project

TRI3ES even does interactive pen and paper role-playing games and storytelling in their Discord to celebrate new NFT drops (I participated and was brutally stomped into the ground by this mighty dragon, ouch)

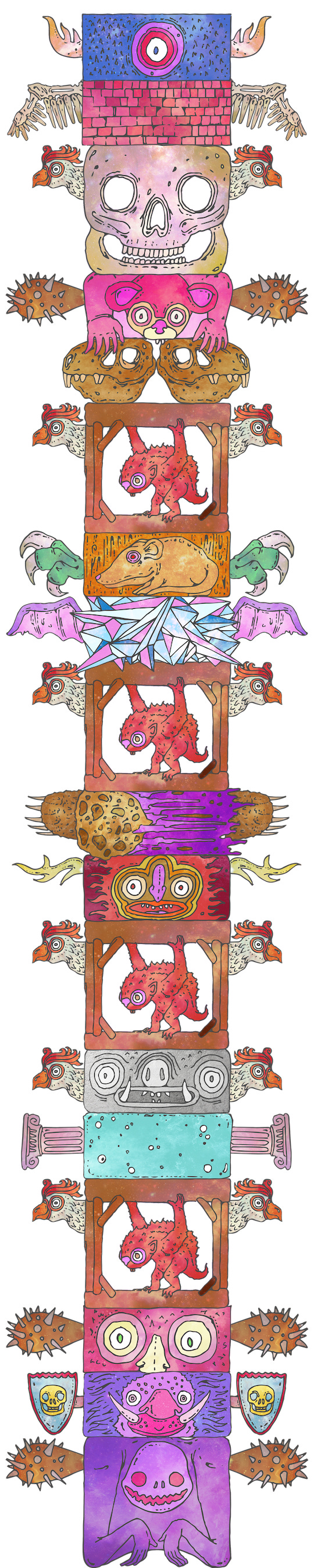

Monster Blocks have introduced the "Stackinator," which lets you stack multiple NFTs on top of each other and create massive towers; size matters again, and well-scrolling mouse wheels even more

Legendary Gary Vaynerchuk's VeeFriends is an exceptional project as those NFTs have brilliant use cases such as tickets to VeeCon, video calls with Gary, personal mentorship, and more

SatoshiFaces reward their holders with a unique staking mechanic, so their ERC-721 NFTs generate ERC-20 tokens daily, which can be used in their whole ecosystem like upgrading the NFTs, or sold on Uniswap

Dizzy Dragons allow their owners to fuse two dragons into one, and they can select one of each property to be used to create the new fused dragon; a great deflationary mechanic as it reduces the total supply

Divine Order of the Zodiac is focused on astrology, so they provide a Zodiac Lookup Tool to let you find your personal NFT based on your natal horoscope

Always Reward Your Early Adopters

Your early adopters take the most considerable risk by getting involved in your project early, and they deserve credit. Early adopters help shape the project; they guide new users and boost your project's growth. Whatever you do, appreciate them and do it for their benefit and make them happy.

The Pixel Vault team rewards its early adopters and encourages the long-term holding of their NFTs by constantly adding value to them, resulting in high demand and increasing prices.

PUNKS Comic started on 2021/05/10 with 10'000 NFTs at a mint price of 0.2 ETH

One month later, comic owners could mint a Mint Pass for 0.08 ETH, which is now redeemable for a MetaHero NFT; or hold the unredeemed pass for a chance to win one of 144 rare MetaHero NFTs

Next, comic holders could burn their comics to receive a Founder's DAO NFT with additional benefits or stake the comic to earn PUNKS tokens which represent a fraction of the 16 Crypto Punks held by Pixel Vault

Holders of "The Set", which contains one of each NFT, are even more rewarded

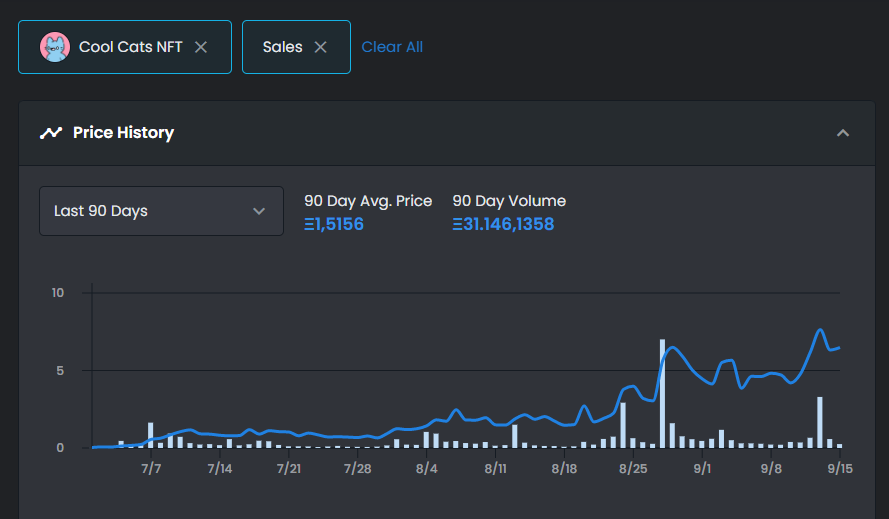

So let's have a look at their floor prices by 2021/09/15:

PUNKS Comic: ~7 ETH

Mint Pass: ~8 ETH

Founder's DAO: ~5.5 ETH

MetaHero Identity: ~6 ETH

Remember, it all started with 10'000 PUNKS Comics for 0.2 ETH. Have a look at their website punkscomic.com to learn more about this excellent ecosystem.

Encourage and Incentivize Long-Term Holders

If you don't give your users reasons to hold your NFTs, it will end up as a quick-flip, which stands for NFTs bought only to sell them quickly for profit - usually during the launch drop phase. Let your community know why holding is worth it and why selling early leads to missed opportunities. Also, keep in mind that the more users hold your NFTs, the fewer will be available on the secondary market; therefore, the floor price will rise faster if there is enough demand. That's precisely what happens for PUNKS Comics with huge demand and only 279 pieces listed for sale on OpenSea by 2021/09/15.

Use Roadmaps to Present Your Vision

Roadmaps are a well-established tool to share your project's vision with the community and build trust as your users see that you've put a lot of brainpower into it. Ensure that your roadmap is high quality and in proportion with the amount of money raised. If you take in 500 ETH through your NFT drop and all you have on your roadmap is a Tesla giveaway and merchandise, it doesn't work out. There's nothing wrong with giveaways and merchandise, but a great roadmap has way more than that. What about the development of, for example, a play-to-earn platform that incorporates your NFTs, future enhancements of your project, introducing deflationary tokenomics, a clever metaverse inclusion, or transforming to a DAO?

2) The Most Wanted Collectibles Often Have Some Coincidental Characteristics

By now, your initial crazy idea evolved into a precisely defined project, and you can't wait to share it with the NFT world. Finally, it's time to give your collectibles a face. At this point, you'll have many questions about your collectibles and how they become most wanted:

What should I design?

What about traits and rarities?

How many should I create?

How should I price them?

How should I generate them?

In the following part, we'll explore all of these essential points and answer them.

Design It With Passion or Not at All

Multiple NFT collectibles are launching daily, and it feels like every animal and its various subspecies have already found a home on the blockchain. So in today's space, it's probably more about how you design rather than what you design. If you put a lot of passion and pixel perfection into your collectibles, the NFT community will appreciate and value this.

That said, you can't expect to be successful with poorly designed artwork unless you're a famous NFT OG (Original Gangster, a well-established and experienced veteran). Once you reach the OG status, you enjoy the community's trust, which is more willing to invest in something absurd made by an OG than by some random person.

Use Clever Traits to Determine Rarities

One of the most exciting experiences in the NFT world is the hunt for rare pieces. But how do we know if something is super rare or just common?

First of all, a collection needs smartly considered traits that help determine rarity. Without these properties, it would remain purely subjective. Finally, rarity is determined by the number of occurrences of each trait and its values. For example, a trait could be the eyes, and its values could be laser eyes, closed eyes, stoned, etc.

Let's head over to the popular NFT rarity checking service rarity.tools and study the number of traits from successful NFT collectibles:

5 traits on Cool Cats

5 traits on Pudgy Penguins

7 traits on Bored Ape Yacht Club

7 traits on FVCK_CRYSTAL//

8 traits on Loot

9 traits on Lazy Lions

9 traits on CryptoPunks

9 traits on Gutter Cat Gang

11 traits on Bulls on the Block

11 traits on World of Women

12 traits on 0N1 Force

On average, we're at about 8 to 9 traits per collection. Now, you may ask how many values each trait should have. There is basically no limit, but keep in mind that the more values each trait has, the harder it will get for the user to compare them. Also, the user needs to have a real chance to get a rare NFT. So if 85% of the collection has only common properties, this won't stimulate the desire to buy. Ideally, you'll find a good average that gives users a fair chance at a rare NFT but without devaluating the super rares. Also, there should be an incentive to hold the common ones.

Have a look at Loot's rarity levels, for instance. After all, there are several ways to achieve a good rarity ratio; the developer you trust will know.

Find the Optimal Mint Count for Your Collectibles

We've spoken about the traits, but what would be the ideal mint count or, in other words, the total amount for your collectibles? First, let's study the pros and cons of a lower vs. higher number. The most common amount is 10'000, but there are also projects with only a few hundred pieces.

A lower number (less than ~3'000) needs less time to be sold out than having a higher number (more than ~10'000). A quick sell-out is a big deal for the marketing, attracting more people as it activates herd thinking and FOMO like "this project must be good if it sold out quickly, I better ape in too". Also, as soon as a project is sold out, people that missed the initial minting on the website or the Smart Contract will try to buy in on OpenSea or other secondary markets. Others try to buy high-value NFTs for undervalued prices (also called sniping) before the artwork is revealed. All these secondary sales generate high trading volume, which leads to greater attention and drives more people to the project.

With a higher amount of collectibles, you'll risk selling out slow, which can signal people to be careful, as the demand seems low (like a FUD signal). Of course, there's nothing wrong with selling slow, but the NFT community generally likes it fast. On the other hand, a larger quantity allows for more unique holders, a bigger community that makes more noise on social media, and therefore you'll get a faster growth rate.

Set A Lower Mint Price for Likely Higher Revenues

How much should a single NFT of your collection cost? It depends highly on what the buyer will get for the price. For example, if you want 1 ETH per piece and provide passionless made graphics, sorry you're NGMI (not gonna make it). Looking at the current market, around 0.06 ETH seems the most common and accepted mint price. However, prices were recently going lower as projects are trying to attract buyers with low entry prices. Even if your project provides more value and use cases, people seem to struggle to pay more than 0.1 ETH per piece at launch. So a lower price appears to be the right way, as the secondary market is getting much more active as more people are involved in sales, resulting in more trading volume and fees generated. Now let's have a look at how to bring your collectibles on the blockchain.

Be Transparent - Verify and Publish Your Smart Contract

There are several ways to create your collectibles, depending on your project size. Smaller collections tend to generate and mint their NFTs individually, while larger collections are usually fully randomized and automatically generated by an algorithm based on rarity tables and graphic layers. Successful collectibles are truly decentralized and typically based on their own verified Smart Contract instead of using one of the available minting services.

Some people will not even bother minting if the Smart Contract has not been verified. They want to feel secure and won't take a chance to lose their hard-earned cryptos or NFTs by connecting to an unverified contract. Unfortunately, hacks are a thing, and the threat is real.

But what does said verification mean? Thanks to my good friend and Solidity developer Cryptogenik, I can explain this process and the subsequent provenance part. So, Verifying a Smart Contract on Etherscan lets anyone read the source code and understand its functions. Without verification, a live Smart Contract is just an unreadable code on the blockchain that most people can't understand. Also, it isn't very easy to decipher what actions the

e Smart Contract will perform. Here's how the verification process works:

A Smart Contract is written in Solidity

Then compiled into EVM code (aka bubble or byte code)

Then written as a transaction on Ethereum

So far, only the unreadable code is out there on-chain in its compiled state

Next, you go to Etherscan and submit the solidity code, along with all the specific parameters used when compiling the script

Etherscan will compile the Solidity, and if the byte code they generate matches the bytecode on-chain, they know it's the original Smart Contract, as any differences would have produced different compiled code

Etherscan gives it a green checkmark and lets anyone inspecting the blockchain see the exact codes used to produce a given Smart Contract

Many more people can read a verified Smart Contract, and it is much easier to understand what is going on. For example, questions like "Does this NFT really do the provenance as they claim on the website?" can only be answered by reading the Smart Contract code.

3) The Initial NFT Drop Is the Most Significant Event

Now that you have prepared everything, it's time to open the gates and let the community mint their highly desired collectibles. If you engaged well enough with the NFT community, all eyes are now on you. Of course, you want the drop to run as smoothly as possible and launch like a full steam space machine, so do everything you can to achieve that.

Avoid Gas Wars

Gas wars suck. It's not cool for your users to pay four times as much gas (Ethereum transaction fees) as your NFT costs. Gas wars occur when there's enormous demand, like 5000 users want to mint an NFT collection of 3000 pieces simultaneously so that gas can become quite untenable. On top of this, the more gas one decides to pay, the faster the transaction will be executed by the Ethereum miners. So the users that can afford it, usually whales, will pay exorbitant transaction fees, while less wealthy users will be left behind. This leads to whales controlling the market for these collectibles and a lower unique holder count, which I'll address later. There are multiple ways to avoid or reduce gas wars and present a healthier distribution of your NFTS; please find some examples below:

Provide minting passes that the users can redeem for the NFT during a specified period

Use a whitelist to allow specific wallets to access the minting procedure

Do a presale for your early adopters

Launch in multiple phases

Set a maximum mint count per transaction

The Project URS did a minting raffle; users could prepay and get randomly selected, and payments got returned if not selected

Be Serious and Provide Provenance

You may have seen a provenance link in several projects and wonder what that is. Provenance essentially shows the immutable origin of each collectible NFT and that it was distributed fairly, meaning nothing goes to specific people.

The reveal process will start once the last collectible has been minted and the whole collection has sold out. This process merges each minted NFT ID with randomized metadata like the traits and the artwork image (think of it like the NFT is the container, and the metadata is the content placed inside it). But how can the creators ensure that they can't manipulate this process for their benefit because they know which IDs are super rare? At this point, serious projects use a random number generator that rotates the whole metadata to NFT ID assignment by a randomly rolled number before the reveal starts. So, for example, the rolled number is 420. So instead of NFT ID 1 getting metadata 1, the minted NFT ID 420 will get the metadata number 0 assigned, ID 421 gets number 1, ID 422 gets number 2, etc.

Here's a more tech-oriented explanation: The provenance is a record of each NFT that will ever exist. So first, each collectible image is hashed using an SHA-256 algorithm, which generates a unique and reproducible hash value that is 64 characters long. So if even one pixel changed, the whole hash would be different. Then all of the hash values for all the images are put together in one final long string and hashed again to generate a new 32-byte hash proof, the final hash that becomes the provenance record stored on the Smart Contract. Remember, what's once on the blockchain can't be edited or removed, so in doubt, a user could compare the hashes of his NFTs with the provenance record. Have a look at BAYC's provenance record to understand it better.

Reveal the NFTs at the Right Moment

Well, you may ask what the right moment is? Let's have a look at the benefits of instant revealing after the drop vs. delayed revealing. Generally, the fast-paced NFT community doesn't like to wait. So while your project has a too long delayed revealing, you may lose momentum because a big chunk of your users already jumped on the next drop. But it also allows for more speculation, so the floor price of your unrevealed NFTs may rise significantly. But the price can also drop drastically if your artwork is poorly received, so try to exceed expectations. Revealing the artwork between 24 to 48 hours usually keeps the community interested while allowing the price to settle on the secondary market from the buyer who couldn't get the NFT on the drop.

Otherwise, with instant revealing, you've got the momentum on your side. You'll have a record peak of users that just minted and now stress OpenSea's "refresh metadata" button while anticipating their revealed collectible excitedly. This usually leads to high trading volumes on the secondary markets, which is excellent.

Don't Underestimate Secondary Sales and Fees

You may ask what these secondary sales are. When a project has its initial NFT drop on its website or Smart Contract, this is called a primary sale, as it is the primary channel to buy these NFTs. Every sale after this happening outside that channel is a secondary sale, typically on NFT marketplaces like OpenSea, Rarible, or H E N.

OpenSea, for example, and the NFT creator will earn fees for every secondary sale on their marketplace. Thus, the revenue from secondary sale fees made can exceed the total income from the initially minted pieces. So, as a creator, you want as high as possible volume on the secondary market. Generally, a 2.5% creator fee is well accepted by the NFT community. However, you may set a higher secondary sales fee if you share it with the community in creative ways such as building a community wallet, a DAO treasury, fractionalized NFT investments, and so on.

Here's an interesting fact about prices: Cool Cats had their sale on July 1, 2021, and struggled to sell at the initial price of 0.06 ETH. After this, they decided to drop the price to 0.02 ETH and sold out almost instantly. Three days later, the floor price was at 0.06 ETH, three weeks later (2021/07/23) over 10x higher at 0.689 ETH. Now fasten your seatbelt: by 2021/09/14, the cheapest Cool Cat NFT is listed for 5.5 ETH, a stunning 275x since their 0.02 ETH launch. Their 7-day trading volume is at ~4268 ETH, so at a 2.5% creator fee, this means over 100 ETH revenue in fees for the creators only for the last seven days. Now let that sync in.

Aim for the Highest Unique Holder Rates

Every single holder is a potential advertiser of your NFT project. So the more happy unique holders your project counts, the more outreach it ultimately has. Because NFT projects are super community-driven, a constantly expanding unique holder base can create a major marketing machine. Also, more unique owners mean the project is healthier and less likely to be at risk from whales controlling and shaking the market. That said, having a few whales onboard is desirable, as it shows they've got the confidence to put a decent amount of money into your project. Others may see this and follow accordingly.

As soon as you have reached a rate of ~40% unique holders, you belong to the most influential projects in this regard. Successful collectibles above this level are the well-known BAYC apes, the crazy Gutter Cat Gang, the unique Ghxsts, as well as the powerfully roaring Lazy Lions, to name a few.

4) Community is Everything

It may sound dramatic, but all above said points are basically useless if you fail to build a community. You can create the most revolutionary NFT, but it will fail if nobody knows about it and no one supports it. So your community is the most critical part of a project and probably also the hardest to get and keep, as you can't just program them like a Smart Contract.

Forget Traditional Marketing

Typical marketing advertisements like Google AdWords, Facebooks Ads, paid Twitter Promotions, display ads like banners, etc., will most likely fail. We're the new cool kids, and this stuff is old skool and may only work for boomers (sorry dad, smile). The NFT community, especially the more experienced and skilled ones, is well connected and organized, mostly in dedicated Discord servers. You'll want to catch their attention, so get creative and find a way to achieve that. It's usually worth way more than the budget spent on those classic ads mentioned above. These users may be harder to convince, but they often become your most loyal and deeply engaged supporters. Of course, I'll provide you with some of the most active known groups, while there are many more secret ones.

A total of 2602 NFT access cards exist with 0.125 and 0.175 ETH original minting prices

Each card is a lifetime membership

Golden OG cards were a surprise for the first 101 members

The first batch sold out quickly and is now available on OpenSea

The first three releases are "Collectors Editions", which combined have a total supply of 2250 NFTs for 0.20 ETH minting price

Edition 4 onwards are considered normal editions, the supply for normal editions is unlimited

As long as you hold a key, you're a member

By now, the first three versions are available on OpenSea

A total of 1500 Metaverse HQ key NFTs exist with minting prices of 0.09 and 0.12 ETH, depending on the sold batch

Memberships are valid till the end of 2022

Keys can be bought on OpenSea

Zeneca is well-known for producing outstanding NFT content like floor price and unique holder analysis, his newsletters, and more

His Discord is free to join; no access NFT is required

You'll need to purchase an NFT that acts as a membership pass/key to access said Discord groups (except for Zeneca's Discord). Just click the links above to find all the necessary information.

Learn How to Use Discord

Suppose you're serious about NFTs and the community. In that case, you'll want to know how to use Discord because it allows excellent ways to structure information and is the main communication channel for NFT users. Have a look at well-established NFT collectibles and how they set up their Discord server. Notably, check their announcements and roadmap channels to get a quick overview of the project. Also well-received are trading channels and bots that post sales from OpenSea in real-time. Most importantly, listen to your community and add channels they may ask for.

Engage and Involve the Community

There is a multitude of opportunities to engage with the community. It's not unusual for the best ideas to come from the community itself. So have an open ear and listen when they make suggestions. Some even go so far as transforming their collectibles project into a DAO. In this so-called decentralized autonomous organization, all further steps are proposed and decided by the whole community. All that have been successful have this in common; a highly active and buzzing community. Here are some common ideas to energize your community:

Communication is everything, don't keep your community in the dark and share every bit of success such as achievement, milestones, or developments

Share your success; for example, share the secondary fees made on OpenSea with the community

Use group calls like Discord Voice or Twitter spaces and engage directly by talking with the community

Have a challenging scavenger hunt that gets your community working together to solve the puzzle

Give them tasks to solve or challenges to win, and reward them accordingly

Participate in competitions with other collectibles to find out who has the most vital community

Run a fun contest for users to find and reward the most creative memes, which they can then use to spread the word further

Provide basic materials like stickers and animated gifs or even Twitter banners for free

Be Present on Established NFT Tools

There are various tools that the NFT community loves to use. This information is beneficial to be aware of as it can boost your project's growth. Below you can find a list of selected NFT tools. It might help to become more familiar with them to ensure your project is listed. Your community will thank you.

Rarity and drop listing tools are used to announce upcoming drops, evaluate each revealed collectible's potential price, and help snipe the rarest NFTs. So make sure to be listed there.

Liquidity supporting tools strive for better distribution and price discovery for NFT projects by creating liquid markets.

Trading tools and platforms are the heart of the NFT community; you want to be highly visible on your chosen platforms. Heads up for NFTTrader, which allows users to trade any listed NFTs with other users through P2P securely; contact them to get your project listed.

Portfolio management tools help to keep an overview, which is especially important for highly active collectors. You'll make sure to get your project integrated, as it will keep you visible amongst all the NFTs a collector owns.

Please reach out and let me know if I miss any must-have tools, and I'm happy to add them.

Last but Not Least: Thank You!

Congratulations, and thank you for reading this far. I know it's long, but I prefer this guide to be a single resource without scanning multiple articles for the aspired info. I also want to thank all my contacts in the NFT community for their very valued input and feedback; without you, this article wouldn't be as complete as it is.

After multiple weeks of researching, fomoing, apeing in, failing, trading, experimenting, and discussing, I'm finally done with this piece, and I'm so happy. Hopefully, this collectible guide will help the NFT community to get more passionately done long-term sustainable projects.

That said, let me tell you that I'm part of a team working on a new NFT collectible project based on this article, so subscribe now to get whitelisted and be amongst the first to know more.

Lastly, I'm asking for your help; please share this article with your favorite Discord server, friends, family, mom, and whoever you want if you like what you just read.

Thank you!

Ninja

absolutely beast article , time will come when I will get big and I will not leave debt , I shall reward you fairly !

such a valuable article, thank you mate!